Do cash and business matter to you, but you're uncertain finance is your field? Examine out similar careers including economics and operations like service administration, accounting and personnels.

There's more to a profession in finance or accounting than merely scrutinising spreadsheets. These typically unsung specialists experience great diversity in their role. Here are a few of the elements of finance jobs pointed out in the survey that demonstrate just why they like their job so much: Today's financial analysts, auditors, accounting professionals and compliance experts are considered valued service partners and essential choice makers. Business rely on their sound guidance to make suggestions and shape strategy. Business progressively want them to speak up and determine problems prior to they get out of hand. In reality, being outbound and client-oriented are crucial strengths for a career in accounting how to get out of a timeshare contract and finance today.

Financing and accounting specialists give senior management precise financial details that executives utilize to meet business objectives and guarantee growth. They are likewise crucial players in strategic decisions such as working with and navigating modifications in tax laws, and many act as leaders in mentoring programs and team building. Fulfilling all of these roles is a source of pride for these experts and make a career in finance and accounting really enticing. Many financing specialists enjoy the scope and vibrant aspects of their jobs. They like having the ability to tap their technological know-how, systematic techniques to problem fixing and deep understanding of how organizations work.

In a financing profession, you should be both detail-oriented and able to see the bigger image. If you're an accounting professional, you were likely drawn to the profession because you are confident dealing with numbers. Many accounting professionals share characteristics such as being extremely organised, sensible and dependable. Possibly you're even is buying a timeshare worth it a borderline perfectionist. You like your task because it fits well with your personality. And when your occupation matches your personality, the outcome is greater profession fulfillment. The 'truth' that people who are excellent with numbers aren't reliable in a team setting isn't a fact however a stereotype. Numerous accountants are extroverted, reasonable and open.

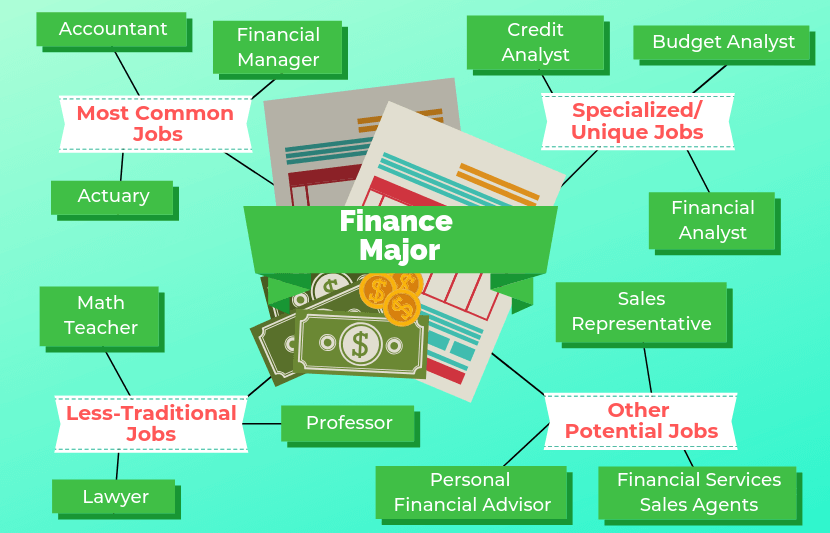

Their tasks allow them to use both the left (analytical) and right (innovative) sides of their brain. Medical professionals specialise throughout their residencies and generally stay with their selected location of medication. Similarly, professional athletes and academics frequently comply with one location of know-how. Not so with accounting and finance experts, who, with some extra training, can deal with a broad series of positions and functions. The capacity for individual and professional development in a financing career is wide and as employers are excited to work with such specialists, this career course uses fantastic upward mobility. An accounting degree or Master of Service Administration, especially when combined with the ideal certifications and continuous training, can open doors to a wide range of jobs.

You could even set out by yourself as a financial expert. As organizations expand, the need for finance specialists is growing, especially positions in accounts payable/ balance dues, accounting, compliance, payroll, and service and budget plan analysis. The outcome: You're not wedded to one business. Whether you're moving or simply ready for a new challenge, the positions are out there. Prior to you request a promo or work out income for a new job, consult the Robert Half Income Guide and our Wage Calculator so you're on strong ground. Aside from your affinity for working with numbers, there are numerous factors a profession in finance is a terrific relocation.

Entering into a finance interview, you can expect a variety of concerns ranging from general work inquiries to complicated mathematical problems. Practicing for this kind of job interview can help you sharpen your critical-thinking abilities and enhance your ability to respond clearly and concisely under pressure. Reviewing common finance interview questions with a buddy or family member is a great way to increase your opportunities of making a great impression - How to finance a house flip. In this short article, we explore numerous typical finance interview questions and offer some sample answers to assist you get ready for your next financing interview. The following area lists twenty possible finance interview concerns that a hiring manager could ask you to examine your expert credentials throughout a company interview.

The smart Trick of How To Finance New Home Construction That Nobody is Discussing

Why have you picked to work in finance?What is the biggest achievement in your financial profession so far?What are your monetary strengths and weaknesses?What are three types of short-term financing that our business could utilize to meet its money needs?What impact would the purchase of a possession have on our balance sheet, earnings statement and capital statement?How is a cash flow statement organized and what does this details inform you?What is the DFC method and why may we use this?What are the different manner ins which you can value a company and which is most suitable for our line of business?Why would a company fund its operations by releasing equity rather than debt?How do you handle high-stress situations with account holders?Employers have an interest in working with professionals who are enthusiastic about their field.

" I selected to operate in finance due to the fact that I enjoy numerical puzzles. I enjoy how monetary formulas might have a single response, but there are many methods to approach it. What do you need to finance a car. Often coming at an issue from the ideal angle is all it requires to increase available funds at an important moment. I find it really satisfying when I can discover that approach." Detailing your biggest achievement not only lets the hiring manager see what you can, however likewise provides a concept of what accomplishments hold the most worth for you. "My greatest accomplishment as a monetary organizer was assisting one of my clients eliminate $60,000 in debt over 2 years and start a college fund for his boy.

For a finance position, you need to make your reaction specific to the abilities and obstacles that you face in this occupation. Answer honestly, however frame your reaction in a manner that makes it clear you're actively working to balance your powerlessness so they do not disrupt your job. "My monetary strength is budgeting. What does ltm mean in finance. I take pleasure in exploring different budgeting techniques and assessing how the ideal type of budgeting can result in more precise forecasting. My weak point is probably consistency. I like to take fresh methods to routine tasks and often need to produce redundant reports so I can provide declarations in a format that's more familiar to supervisors monthly." If your company discovers itself in a tough financial situation, it will need a finance expert who knows how to solve the issue rapidly.

" To meet immediate money needs, I would recommend using trade credit, bank loans or a bank overdraft. After solving the instant cash flow issue, I would prioritize an extensive review of all financial declarations to prevent this type of circumstance in the future." This question tests your financial knowledge regarding purchases. Offer a concise answer that's easy for any professional to comprehend, despite their financial knowledge. "The purchase would increase your properties on the balance sheet. On the year-end earnings statement, this asset will have devaluation. On the capital declaration, the purchase can count as an http://gregorythbp843.raidersfanteamshop.com/some-known-details-about-how-long-can-you-finance-a-used-boat investment activity." Finance experts need to know how a capital declaration is arranged and what this file can tell them.